The question is not who will take care of you when you live a long life and need care – it’s what providing that care will do to your family and your retirement portfolio.

Long Term Care is an integral part of the estate planning process. Asset protection is a conversation that must be included as part of wealth preservation, and Long Term Care is a vital tool in both business and individual planning.

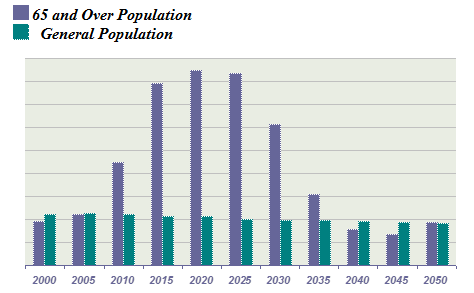

More than half of all women and a third of all men who survive to age 65 are expected to spend time in a nursing home before they die. Further, according to the census bureau, the percent of people 65 and older is an increasing percentage of the population over the next decade:

The preservation of assets and how long term care may adversely affect the work you are doing now unless steps are taken to avoid this loss definitely has a place in your estate and business planning.

Perhaps the following chart is a great place to start with your clients who think that self funding their Long

Term Care is a great idea:

| Year | Assets in Savings | Annual Yield From Savings | Total of Assets | Income Required | LTC Expense | Total Cost of Living | Savings Balance |

| 1 | $500,000 | $30,000 | $530,000 | $50,000 | $45,000 | $95,000 | $435,000 |

| 2 | $435,000 | $26,100 | $461,100 | $52,500 | $47,700 | $100,200 | $360,900 |

| 3 | $360,900 | $21,654 | $382,554 | $55,125 | $50,582 | $105,707 | $276,867 |

| 4 | $276,867 | $16,612 | $293,479 | $57,881 | $53,596 | $111,477 | $182,002 |

| 5 | $182,002 | $10,920 | $192,922 | $60,775 | $56,811 | $117,586 | $75,336 |

| 6 | $75,336 | $4,520 | $79,856 | $63,814 | $60,220 | $124,034 | BROKE |

Our Long Term Care department can give you the assumptions used in these charts; more importantly, they can show you the nuts and bolts of the conversations that should go with them.

Using the very best products in the industry, they can help you develop a long term care portfolio and the planning techniques to support your clients.